Inflation meaning

What is inflation? To really understand inflation, you need to know what money is and why we use it. Money represents the value of hard work and producing things that other people want to use. The measurement of this production or hard work is done with units of money. If I spend $20 to buy a can opener, that $20 represents an hour of work serving food at a restaurant as an example. You can see this by looking at a job that pays wages by the hour, and then taking those wages and buying things that you do not produce to obtain all of the things that you need to live. The backbone of this idea is exchanging and trading goods, because making everything you need by yourself may not be possible.

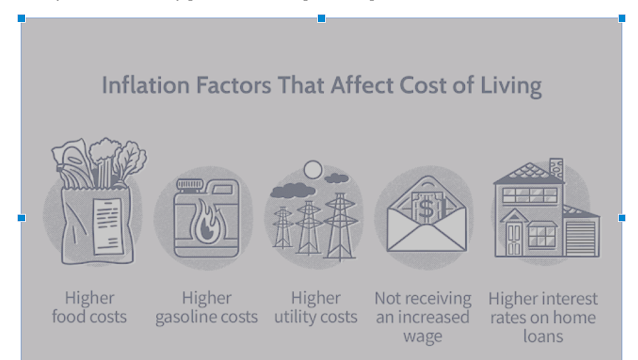

The assumption people make is that $20 today is $20 tomorrow. Actually it is not. The prices of things are constantly changing, and the value that this $20 can purchase depends on when you use it and what you buy with it. Want proof? Look at the price of food items, gasoline, education, rent, utilities and many household goods and services over time. Prices are going up most of the time for most items and this $20 is buying less and less every year. To see a drastic comparison, in 1920, $20 bought you a suit, a belt and a new pair of shoes. Today this $20 may buy you a belt only. Inflation is when the prices are rising and more money is needed to purchase things of identical quantity and quality. Deflation is when the same money is buying more things of identical quantity and quality. This has been happening with technology, clothing and internet shopping as some examples.

Inflation is also defined as the rate at which the prices are increasing, and the rate at which the value of the dollar is falling. What can you do about it? Back in the 1970s and 1980s, you would get raises at your job each year that were at least equal to the rate of inflation or the rate at which the value of the dollar was falling. This allowed you to buy the same things for the same amount of work that you were doing. As an example, if you made $20 per hour in 1970, you can purchase 5 litres of milk for $20. In the following year, the price of milk increased to $21, and your wage would increase to $21 and you can buy the same amount of milk for an hour of labour. If you are an investor, you would park money in a bank account with an interest rate that was the same or higher than inflation so that you can buy the same or more goods with the capital you had invested. If you were a landlord, you would increase your rent by 5% to counteract the increase in your expenses of 5% such that your rental property would create the same amount of profit in spite of inflation.

Calculate for inflation

What happens if you don't get this raise, or investments are not paying a return equal to inflation? The value of the work you are doing becomes worth less, or the amount of goods you can buy for your work becomes less. The value of the investment capital also becomes worth less over time. If this trend continues for a long period of time, your labour will not allow you to buy very much and you will be approaching enslavement. Once the capital diminishes to the point that nothing can be purchased with it, this is called insolvency.

The solution is to find labour, investments or assets that would retain their purchasing power in spite of inflation. For labour, it is to obtain wages that would rise each year. For investments, the income yield or rate of growth should be higher than inflation. For assets, these would be physical, tangible things that would still be useful in spite of what the currency is worth. These are assets that people always need: Food, water, shelter, land, productive capacity (tools, equipment), and precious metals for use as currency.

How do you know the effect that inflation is having on your purchasing power? You need to look at how much your income or capital is increasing each year versus how much the things you need are increasing in price every year. The government puts out an average number called the Consumer Price Index (CPI) which is supposed to capture this for the average person. To know your personal impact, you need to calculate what your income and spending amounts are as they change with time, preferences and income generating ability.

Do you want to: Learn how the world of money really works without the need of a time consuming or expensive course of study? Discuss what you want to achieve according to your horizon? Restructure your finances to achieve your goals? Advice that is not affiliated with any institution or any product - an independent opinion?

If you answered yes to any of these questions, contact me at: Contact me, Joe Barbieri by email at joetheinvestor.today@gmail.com, my web site at http://www.joetheinvestor.ca or by telephone at 647-286-8020 for an independent consultation on what your options are. Note: This article is intended for people who want to learn about the world of finance and how to research for themselves. If you would like to buy or sell investment products, or specific advice on investment products, tax or legal issues, please consult your investment advisor, accountant or legal counsel.

Article Source: https://EzineArticles.com/expert/Joe_Barbieri/1377173

Article Source: http://EzineArticles.com/10434418

Faqs related to Inflation Explained

What inflation is

Inflation is the rise in prices of goods and services over a period of time. This often happens due to an increase in the money supply, which leads to an increase in the price of goods and services. There are two main types of inflation -- consumer inflation and producer inflation. Consumer inflation refers to increases in the prices that individuals pay for items such as food, housing, utilities, and transportation. Producer inflation occurs when companies receive more expensive inputs (such as gasoline) because there's been an increase in money supply or demand for their products.

Overall, it's important to be aware of both consumer and producer inflations so that you can make smart financial decisions related to your investments, savings goals, spending habits etc.

How inflation rate is calculated

The inflation rate is defined as the percentage change in the general price level of goods and services over a period of time. To calculate it, you first need to calculate the annualized percentage change (APC), which accounts for both short-term and long-term fluctuations. Next, you divide this figure by 12 to get a monthly average inflation rate. And finally, you multiply this figure by 100 to obtain a yearly average inflation rate.

In other words

Inflation is calculated by taking the Consumer Price Index (CPI) and dividing it by 100. The CPI is a monthly measure of prices that consumers pay for goods and services across various sectors of the economy.

What inflation rate

There is no one answer to this question as it depends on a variety of factors, including the economy, political climate, and global events. However, historical averages suggest that inflation rates tend to be around 2-3% over time.

Will inflation go down

There is no guarantee that inflation will go down, but there are a number of factors that could contribute to its decline. If the global economy strengthens and consumer demand increases, then prices may rise gradually over time. Additionally, if governments continue to reform their economies by reducing debt levels and implementing fiscal policies that promote growth, then inflation might drop more rapidly than expected. In fact, some experts believe that we could see deflation in the next decade or two. However, it is impossible to say for sure what will happen; all we can do is stay informed and make prudent financial decisions accordingly!

Why inflation is bad

Inflation is bad because it leads to a decrease in the value of your money. This can impact both individuals and businesses, as prices for goods and services increase over time. Additionally, inflation can erode the purchasing power of people's wages and savings, making it difficult to get ahead financially.

Why inflation is good

Inflation is a fact of life and should be embraced. It's good for the economy because it causes people to spend more money, which in turn creates jobs. Additionally, when inflation is low, it can lead to deflation – or a decrease in the value of currency – which can cause economic hardship.

For these reasons, you should always keep an eye on inflation rates so that you are aware of any changes and make informed decisions about your investments.

Who is to blame for inflation

There is no one person or organization to blame for inflation, as it is the result of a number of factors. These include economic growth, increased demand for goods and services, technological advancement, and fluctuations in global money supply.

It's important to be aware of the consequences associated with high inflation rates so that you can make informed investment decisions. This includes understanding how debt affects your financial situation and knowing what kinds of investments are likely to experience volatility due to elevated inflation rates. In short, by staying up-to-date on current events related to inflation, you can help protect yourself from future losses while still achieving your financial goals.

Will inflation go down in 2023

While it is impossible to predict the future, one of the trends that is likely to continue in the next year or two is inflation. This means that your investments are likely to go up in value over time, and as a result, you may want to invest your money elsewhere.

Inflation typically decreases when there's an economic recession, so it's important to monitor both events closely in order for either scenario – deflationary or hyperinflationary –to play out. However, overall inflation will tend to increase over time due to increased prices for goods and services. As such, it can be helpful (although by no means essential)to have some basic financial knowledge so that you can make informed decisions about how best allocate your resources.

.png)

No comments:

Post a Comment